Global

Impact

The U.S. auto industry fuels innovation, economic growth, and national security through advancements in AI, autonomous vehicles, and EVs, driving job creation, export growth, and reduced reliance on foreign tech.

Worldwide Industry Leadership

Worldwide Industry Leadership

A healthy and competitive auto industry is vital to U.S. economic and national security, serving as a cornerstone of innovation, manufacturing, and employment.

As the race to develop AV technology accelerates, U.S. leadership ensures technological advancement, job creation, and economic efficiency by revolutionizing logistics, ride-sharing, and public transportation. Domestically produced AV systems reduce reliance on foreign technologies, minimizing supply chain and cybersecurity risks. Their defense applications, such as autonomous military transport and reconnaissance, highlight their strategic importance.

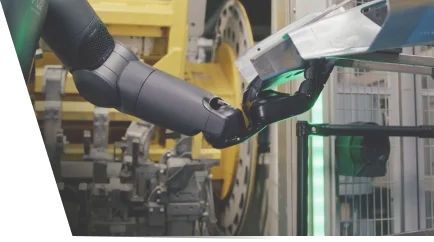

Automation and Artificial Intelligence in the auto industry

As the race to develop AV technology accelerates, U.S. leadership ensures technological advancement, job creation, and economic efficiency by revolutionizing logistics, ride-sharing, and public transportation. Domestically produced AV systems reduce reliance on foreign technologies, minimizing supply chain and cybersecurity risks. Their defense applications, such as autonomous military transport and reconnaissance, highlight their strategic importance.

"The United States is the global leader in developing AI, but it faces fierce and increasing competition from China. Focusing on stymying China's growth will not impede China's progress in the long run. Instead, the United States should be focusing on maintaining, if not expanding, its lead."

How does Artificial Intelligence Fuel Next-Generation Vehicle Technologies?

Production

Safety

Convenience

Innovation

- Design Engineering

AI can be used to accelerate and optimize the vehicles design process, reducing the amount of time it takes to finalize and validate a new design.

- Manufacturing

AI can help detect potential anomalies, conduct root cause analysis, and support production scheduling.

- Supply Chain Management

AI can help companies better manage inventory and forecast demand.

- Smart Voice Assistants

In-cabin voice assistants powered by AI can help facilitate drivers keeping their eyes on the road.

- Crash Avoidance Features

Next-generation Advanced Driver Assist Systems (ADAS) are increasingly integrating AI to help avoid crashes.

- Occupant Safety Features

In-vehicle features that help detect unattended children or help ensure that drivers remain engaged in the driving task may rely on AI.

- Personalization of Services

With AI, the vehicle can learn to adjust music, lighting, and other conditions to meet the unique needs of drivers and passengers.

- Predictive Maintenance

Next-generation Advanced Driver Assist Systems (ADAS) are increasingly integrating AI to help avoid crashes.

- Navigation

AI helps drivers find the optimal route to a destination and more safely and efficiently navigate complex traffic situations.

- Automated Vehicles

Automated vehicles rely on sophisticated machine learning algorithms that draw meaningful conclusions from sensor data.

- Electric Vehicles

AI can help interpret capacity utilization and charging times data to direct drivers to the nearest available charging station.

Connectivity and Cybersecurity

Connectivity and Cybersecurity in a Connected Auto Industry

As vehicles grow more connected through advanced communication technologies, the auto industry becomes increasingly vital to national security.

Connected vehicles rely on data exchange with infrastructure, other vehicles, and central systems, enabling innovations like real-time traffic management and predictive maintenance. However, this connectivity introduces cybersecurity risks. A strong domestic auto industry ensures robust encryption and security protocols to protect against cyberattacks. U.S. leadership in this technology builds consumer and ally trust, strengthens the economy, and reduces vulnerabilities to external threats.

What are automakers doing to address cybersecurity?

Automakers engage with the cybersecurity community, including, government, private-sector firms, standards organizations, academia, research and testing facilities, and more.

In 2015, automakers worked with government stakeholders to proactively launch the Automotive Information Sharing and Analysis Center (Auto-ISAC). The Auto-ISAC provides a forum to share information, as well as partner with vendors, associations, researchers, government and academia to build relationships beyond the membership.

Learn MoreAmericans agree: a strong American automotive industry is critical to national security.

Poll: Two-thirds of Americans believe a strong auto industry in the United States is critical to national security. (67 percent)

Alliance for Automotive Innovation Poll, December 2024Elements of Intellectual Property in a Vehicle

Manufacturing + Production

Auto manufacturing is the hallmark of Global Economic Leadership

Among G20 countries (comprising the major economies of the world), all but two produce automobiles. The G20 represents 85 percent of the world's gross domestic product (GDP), and those countries produce about 86 percent of the world's motor vehicles.

| 2004 Production | 2023 Production | 2004 % World Total | 2023 % World Total | 20 Year % Change of World Total | |

|---|---|---|---|---|---|

| China | 5,234,496 | 30,160,966 | 8.12% | 32.24% | 32.24% |

| USA | 11,989,387 | 10,611,555 | 18.59% | 11.34% | -39% |

| Japan | 10,511,518 | 8,997,440 | 16.30% | 9.62% | -41% |

| India | 155,157 | 5,851,507 | 2.34% | 6.26% | 167% |

| South Korea | 3,469,464 | 4,241,597 | 5.38% | 4.54% | -16% |

| Germany | 5,567,954 | 4,109,371 | 8.64% | 4.39% | -49% |

| Mexico | 1,577,159 | 4,002,047 | 2.45% | 4.28% | 75% |

| Brazil | 2,317,227 | 2,324,838 | 3.59% | 2.49% | -31% |

| Canada | 2,711,536 | 1,553,026 | 4.20% | 1.66% | -61% |

| France | 3,665,990 | 1,505,076 | 5.68% | 1.61% | -72% |

| Turkey | 823,408 | 1,468,393 | 1.28% | 1.57% | 23% |

| Indonesia | 408,311 | 1,395,717 | 0.63% | 1.49% | 136% |

| UK | 1,856,539 | 1,025,474 | 2.88% | 1.10% | -62% |

| Italy | 1,142,105 | 880,085 | 1.77% | 0.94% | -47% |

| Russia | 1,386,127 | 729,864 | 2.15% | 0.78% | -64% |

| South Africa | 455,702 | 633,337 | 0.71% | 0.68% | -4% |

| Argentina | 260,402 | 610,725 | 0.40% | 0.65% | 62% |

| Australia | 411,406 | - | 0.64% | - | - |

| Saudi Arabia | - | - | - | - | - |

| G20 Total | 55,301,888 | 80,103,018 | 85.7% | 86% | |

| World Total | 64,496,220 | 93,546,599 |

- Vehicles Produced

- Average Production Over the Last Decade

After U.S. light vehicle production decreased by about 2 million vehicles (or nearly 20 percent) due to the pandemic and subsequent supply chain disruptions, 2023 saw production nearly back to pre-pandemic levels - down only about 2 percent from 2019. That said, overall sales of light-duty vehicles in the U.S. are still down roughly 1.5 million units (2023 vs 2019).

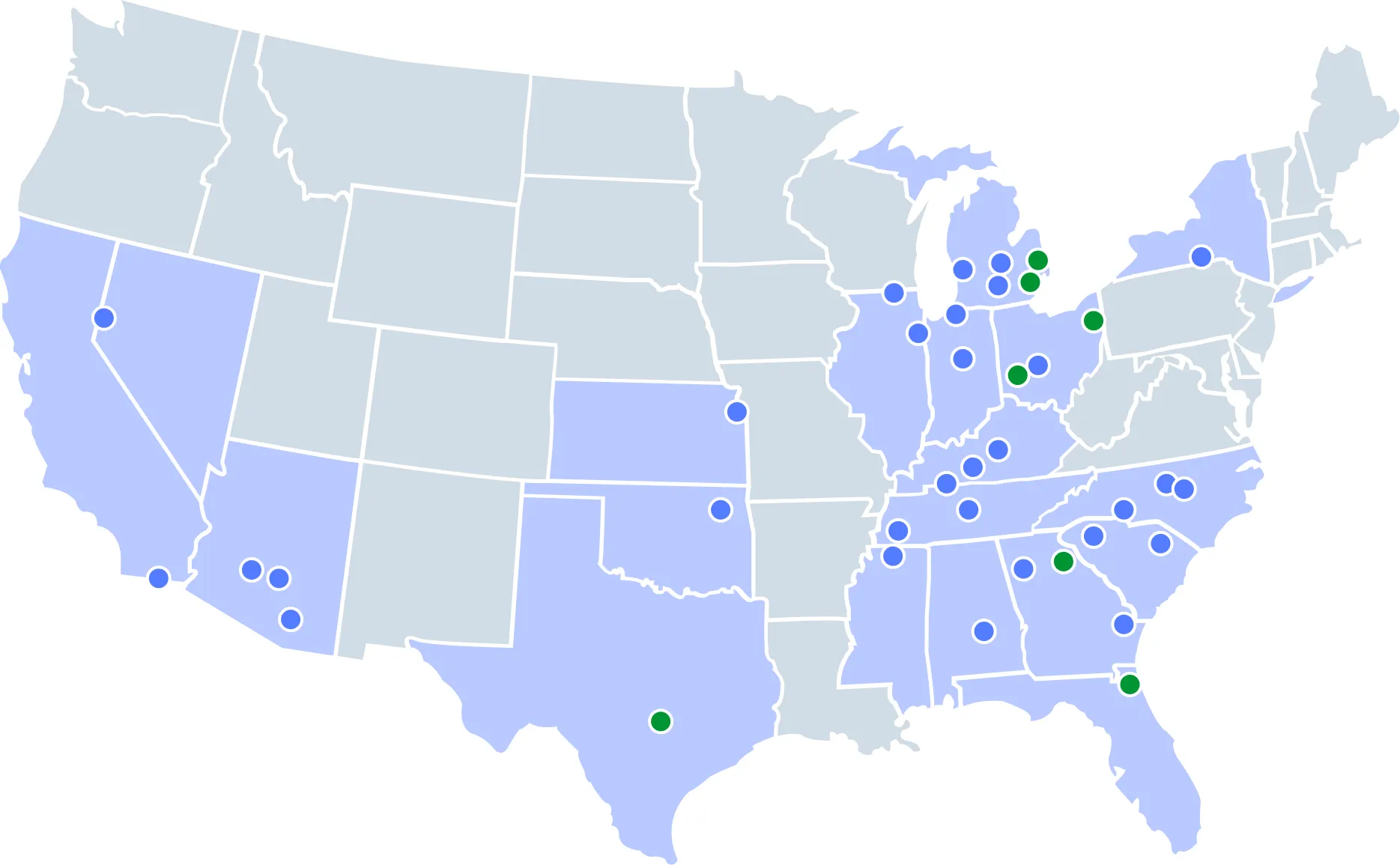

Americans Take Great pride in their country's leadership in producing vehicles in the U.S.

Across 15 states, 50 vehicle assembly plants are producing cleaner, safer, and smarter vehicles while providing tens of thousands of direct jobs and boosting local economies.

Nearly 250,000 workers are employed at assembly plants producing more than 10.3 million vehicles across the U.S. - and there's more on the way.

Four additional assembly facilities have been announced - all building new electric vehicles - joining the 25 existing facilities that have been (or will be) retooled for electric production.

More than $90 billion committed to EV battery production and creating more than 65,000 new jobs (from 2019-September 2024).

America is Taking Charge

- Announced Battery Plant

- Active Battery Plant

Exports + Port Economics

Growing Auto Activity at American Ports

Motor Vehicles & Parts were the second largest U.S. export in 2023- More than $143 billion in goods.

Since 2008, exports of motor vehicles and parts from U.S. ports to destinations around the globe increased 33 percent. Two-thirds of the world imported more from the U.S. than it did 15 years ago - some regions increased by nearly 50 percent or more.

Auto Exports Across the Globe

| Region | Motor Vehicle & Parts Exports** | 15-Year Change |

|---|---|---|

| Africa | $1.7B | -38% |

| Asia | $23.0B | 49% |

| Australia and Oceania | $3.6B | 119% |

| Europe | $19.7B | -2% |

| North America | $89.9B | 43% |

| South/Central America | $5.3B | 16% |

| Grand Total | $143.2B | 33% |

In 2023, U.S. Ports Handled More Than $557 billion In Motor Vehicles and Parts Trade.

The U.S. shipped nearly $42 billion more in vehicles and parts in 2023 than it did in 2008.

Of that, three-quarters came from increased exports to our North American partners while 20 percent was from an increase to Asia ($8.3 billion).

Most Active State for Light Vehicle Related Trade 2023 (Exports & Imports)

| State |

Motor Vehicle & Parts Trade** Trade Value Value |

Motor Vehicles & Parts as a % of Total State Trade % of Total State Trade |

|---|---|---|

| MI | $135.2 B | $58% |

| TX | $80.7 B | $10% |

| CA | $52.9 B | $9% |

| TN | $23.6 B | $16% |

| AL | $22.7 B | $35% |

| GA | $21.1 B | $11% |

| SC | $21.0 B | $24% |

| OH | $19.0 B | $15% |

| MD | $16.8 B | $26% |

| IN | $15.4 B | $12% |

| Top 10 Total | $408.4 B |

| AL | $12.24 B value | 45% of total |

| MI | $27.58 B value | 42% of total |

| MO | $3.76 B value | 21% of total |

| OH | $9.98 B value | 18% of total |

| SC | $11.63 B value | 31% of total |

| TN | $4.78 B value | 13% of total |

| DC | $217 M value | 12% of total |

| IN | $8.86 B value | 16% of total |

| KY | $5.72 B value | 14% of total |

| OR | $6.17 B value | 22% of total |

| WV | $6.17 M value | 21% of total |

| IL | $5.52 B value | 7% of total |

| MD | $1.39 B value | 8% of total |

| MS | $894 M value | 6% of total |

States with the Largest Percentage of Exports from Motor Vehicle & Parts (2023)

| State |

Value of Exported Motor Vehicles & Parts Exported Value Value |

Motor Vehicles & Parts as a % of Total State Exports % of Total State Exports |

|---|---|---|

| AL | $12.2 B | $45% |

| MI | $27.6 B | $42% |

| SC | $11.6 B | $31% |

| OR | $6.2 B | $22% |

| WV | $1.2 B | $21% |

| MO | $3.8 B | $21% |

| OH | $10.0 B | $18% |

| IN | $8.9 B | $16% |

| KY | $5.7 B | $14% |

| TN | $4.8 B | $13% |

| Top 10 Total | $91.9 B |

Far away from traditional auto hubs like Detroit, ports from coast to cast are buzzing with automotive trade activity.

Auto Exports Across the Globe

| Port |

2023 Value of Goods |

% of Ports Total |

|---|---|---|

| Laredo, TX | $59B | 18.4% |

| Detroit, MI | $43.9B | 25.3% |

| Brunswick, GA | $28.2B | 87% |

| Baltimore, MD | $26.9B | 33.4% |

| Port Huron, MI | $19.9B | 15.7% |

| Newark, NJ | $17.3B | 7.2% |

| Los Angeles, CA | $16.9B | 5.8% |

| Charleston, SC | $14.8B | 14.6% |

| Jacksonville, FL | $13.5B | 47.2% |

| Port Hueneme, CA | $12.6B | 78% |

The Auto Industry Is A Big Customer of Rail Freight

“Each year, freight rail moves nearly 75% of the new cars and light trucks purchased in the U.S. In a typical year, railroads carry 1.8 million carloads of motor vehicles and parts.”

- Association of American Railroads.

Research & Development Highlights

Staying competitive in a global marketplace requires investing in future innovations.

More than $690 billion was spent on research and development activities by businesses in the United States in 2022. More than $32.8 billion (4.8 percent) was invested by the auto industry - the fourth highest for any manufacturing industry group.

About 93 percent, or nearly $31 billion of U.S. R&D investment in autos, comes from the industry (including suppliers). For comparison, the aerospace indstry spent $35.4 billion on R&D in 2022 - more than half of which was paid for with federal funds.

Automakers made significant capital investments in 2022, allocating $2.2 billion to R&D facilities equipment.

- 2% Texas $4.98B

- 18% California $6.038B

- 4% Indiana $1.438B

- 8% Ohio $1.3B

- Michigan

- Texas

- California

- Indiana

- Ohio

- Other States

-

Smarter R&D

13% spent on software

Thirteen percent of motor vehicle R&D spending is spent on software products ($3.5B, 11%) and artificial intelligence ($769M, 2%).

-

Smarter R&D

$ 128M committed

E2 estimates an additional $128 million committed to clean vehicle R&D in the past two years, with more than 1,200 jobs associated with those announcements.

-

1 in 10

More than one in 10 auto jobs are R&D focused. 12 percent of all motor vehicles & parts employment is in the research and development space.